taxing unrealized gains is unconstitutional

The Biden administrations idea to tax billionaires unrealized capital gains may sound good to the tax-the-rich crowd. Its retroactive application violates a principle of the rule of law.

The Biden Administration S Cynical And Unconstitutional Proposed Tax On Wealth

Fifth a tax on unrealized capital gains is flatly unconstitutional.

. In practice it would be an unworkable and arguably. By LU Staff March 29 2022. The idea is that for billionaires only annual gains in wealth would be treated as income.

Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that. In a simple scenario investors could end up paying the tax man for gains.

A tax on unrealized capital gains might. The Heritage Foundation said that the tax is unconstitutional The constitution is very clear when it states that tax has to be apportioned among the several states and cant be specific like. Democrats proposed funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million per year or.

A tax on unrealized gains is clearly not in compliance with. Under current tax law unrealized gains are not considered income by the irs and are therefore not taxable. Likewise a tax on unrealized capital.

By taxing the investors income twice the government double-dips and potentially deters investment and. In order to get around this constitutional reality the 16th Amendment was adopted to allow the income tax. The government contended that the landlord realized a gain of 5143425 the difference between the value of the building at the date of repossession and the landlords.

If mark-to-market taxation of capital gains is a direct tax is not covered by the 16 th Amendment and is not apportioned then it is unconstitutional. An income tax is the obvious example and indeed income taxes were held unconstitutional until we ratified the 16th Amendment. Biden proposes unconstitutional wealth tax.

Any after-tax income used to invest is taxed again upon realized gains. Taxing unrealized gains is effectively the same as taxing someone for something they dont possess. If mark-to-market taxation of capital gains is a direct tax is not covered by the 16 th Amendment and is not apportioned then it is unconstitutional.

It could well be unconstitutional. Joe Biden has released a plan to tax unrealized gains which the federal government doesnt. Taxing unrealized gains requires a re-definition of the word income Whether an attempt to tax unrealized gains would pass Constitutional review requires a study of the.

The small number of people targeted by it raises concerns about consent of the. Likewise a tax on unrealized capital. An income tax is the obvious example and indeed income taxes were held unconstitutional until we ratified the 16th Amendment.

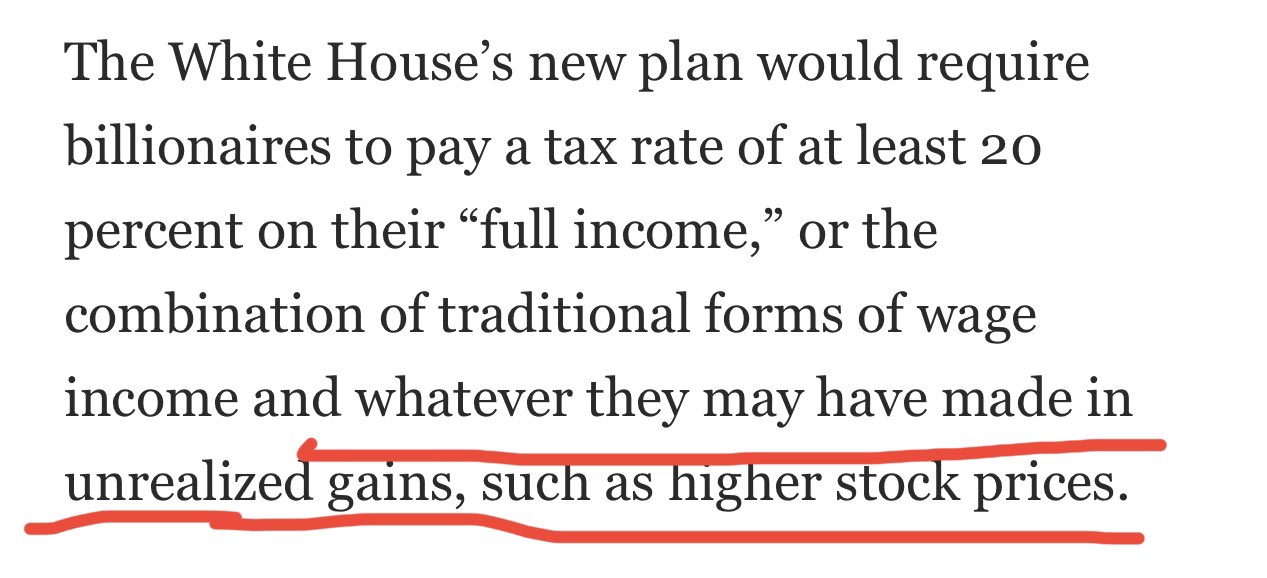

In a nutshell its a 20 tax on the unrealized capital gains hang on to that thought of American households worth at least 100 million. So under current law someone whose net worth rose to 22 billion from 20 billion.

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Biden S 20 Billionaire Tax Hits 100m Up Taxing Unrealized Gains

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Another Unconstitutional Wealth Tax

How Warren Could Get A Wealth Tax Past The U S Supreme Court

Houston Rockets Owner Our Great Capitalism Will Come To An End If Dems Pass Unrealized Gains Tax Fox News

Biden S Tax On Unrealized Gains Will Hit Far More Taxpayers Than He Claims The Hill

Is There Any Logic Behind Taxing Unrealized Gains R Amcstocks

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

The Madness Of Taxing Unrealized Capital Gains Mises Wire

Digging Further Into The Question Is Taxing Unrealized Gains Constitutional Mish Talk Global Economic Trend Analysis

Oops Manchin Now Denounces The Democrats Wealth Tax On Billionaires Mish Talk Global Economic Trend Analysis

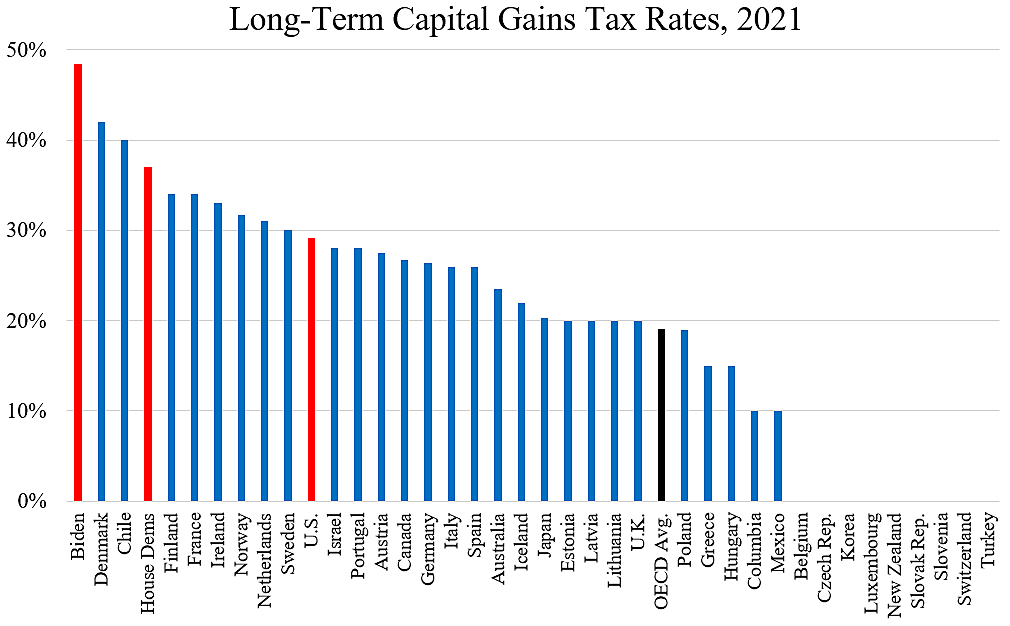

Tax Rates On The Rich Cato At Liberty Blog

Taxing Unrealized Capital Gains The Crazy Fed Proposal To Tax Profits That Don T Exist Scottsdale Bullion Coin

Jason Furman On Twitter This Is A Landmark Proposal From President Biden A Minimum Tax That Also Applies To Unrealized Gains As A Prepayment Against Future Capital Gains This Should Get Serious Consideration

Explainer Democratic Billionaires Tax Proposal Likely To Face Legal Challenges Reuters

/cdn.vox-cdn.com/uploads/chorus_asset/file/19257471/1144341633.jpg.jpg)

Ron Wyden S Capital Gains Tax Plan Would Hit And Change Philanthropy Vox

Capital Gains Taxes And The Democrats Cato At Liberty Blog

Why Congress Shouldn T Rush To Enact Poorly Conceived New Taxes To Fund Spending Spree The Heritage Foundation